The frenzied pace of infrastructure build-out in the post-Covid years hit a speed breaker in FY25, with the government spending less than the budgeted amount. For FY26, the allocation of ₹11.21 lakh crore is still substantial with a 10 per cent increase year on year. In recent months, projects and contracts have been rolled across many key infrastructure segments.

The Q1 GDP growth numbers have been buoyed by a 7.8 per cent year-on-year increase in gross fixed capital formation (GFCF).

One of the key segments where there is considerable emphasis is power, where stiff generation targets over the next 5-10 years mean more projects in the transmission and distribution sectors.

Transrail Lighting is a key EPC (engineering, procurement and construction) player in the T&D segment and has presence both in India and 58 other countries globally. The stock listed in the exchanges in December 2024 and is up over 74 per cent from the upper end of the IPO price band (₹410-432). Back then, BL.Portfolio had recommended that investors subscribe to the IPO. Looking at its valuation, business and prospects today, the risk-reward continues to remain attractive for long-term investors.

At ₹763, the Transrail Lighting stock trades at 20 times its likely per share earnings for FY26.

Among small- and mid-sized EPC companies, the likes of Vikran Engineering, SPML Infra, and Techno Electric & Engineering trade at 25-40 times forward earnings. The BSE Capital Goods Index trades at nearly 55 times. Larger peer KEC International is available at 23 times forward earnings.

Given the relatively attractive valuations and strong growth prospects, investors can buy the shares of Transrail Lighting from a three-year perspective.

A large order-book, healthy global footprint, focus on projects that deliver robust margins, and a reliable track record work favourably for the company’s long-term prospects.

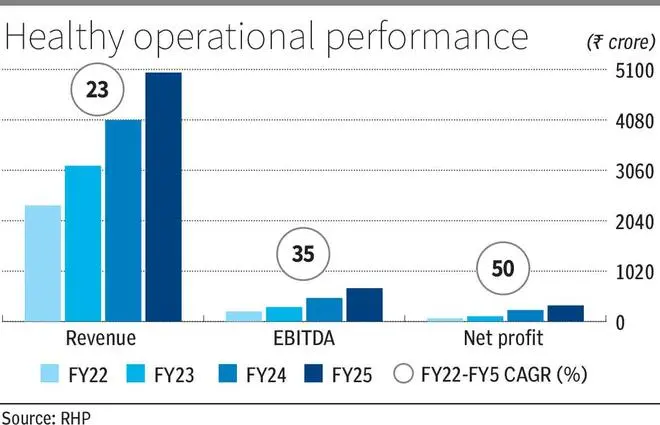

Between FY22 and FY25, Transrail Lighting’s revenue grew at a compounded annual rate of 23 per cent to ₹5,308 crore in FY25, while EBITDA grew at a faster CAGR of 35 per cent to ₹676 crore over the same period. Net profits expanded at the rate of 50 per cent over FY22-25 to ₹327 crore in FY25. The company’s EBITDA margin of 12.7 per cent is among the highest in the industry.

In Q1 of FY26, the company’s revenue grew 81 per cent year on year to ₹1,660 crore, while net profits rose 105 per cent to ₹106 crore. EBITDA expanded 66 per cent over the same period.

Transrail Lighting has kept the debt in its balance sheet well in control over the past few years. From a net debt-to-equity ratio of 0.78 in FY23, the metric has more than halved to 0.37 by Q1FY26.

Strong execution, global presence

The company has been around for about 40 years and has a footprint in 59 countries – 27 in Africa, 16 in Asia, seven in North America, five in South America and four in Europe.

Transrail Lighting is predominantly a player in the power T&D space (93 per cent of order-book). Other minor divisions include civil construction, railway projects, and poles & lighting.

It mainly executes projects relating to transmission lines, AIS and GIS substations, underground cabling, rural electrification, 800kV HVDC lines and HTLS conductors.

The company has constructed 35,200 CKM of transmission lines, supplied more than 1.38 million MT of towers, 195,000 km of conductors and 475,000 poles.

Transrail Lighting has in-house design, manufacturing, testing and installation facilities. One of the key reasons for the company’s healthy margins is that self-manufactured products contribute 65-70 per cent of contract value in various projects as having full control over critical components ensures cost, quality and delivery advantages.

As of June 30, 2025, the company had an order-book of ₹14,654 crore, which is 2.8x the FY25 revenues of the firm. Including projects where it is the L1 bidder, the total order-book goes up to ₹15,637 crore.

Transrail Lighting’s order-book composition is 60 per cent domestic projects and 40 per cent international contracts, making it well-diversified.

A report from CRISIL indicates that India’s transmission and distribution EPC market is set to grow from $13.5 billion in 2024 to around $21 billion by 2039.

According to Power Grid Corporation’s CMD, India’s transmission lines network is set to rise from 485,000 circuit km in 2024 to 648,000 circuit km by 2032.

Transmission and distribution lines investment in Africa ($4 billion by 2029), India ($24-25 billion) and the Asia-Pacific ($127 billion) are set to grow steadily over the next few years.

These capacity buildouts and investments present considerable opportunities and growth runway for companies such as Transrail Lighting.

Published on September 6, 2025